vermont income tax rate 2021

Than filing filing. Find and Complete Any Required Tax Forms here.

Personal Income Tax Department Of Taxes

2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

. Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189. If you make 116480 a year living in the region of New York USA you will be taxed 26395. 2021 2020 Unearned Income wo Kiddie Tax 2200 Child Tax Credit 2000 Family Tax Credit Non-child dependent 500 500 Auto Standard Mileage Allowances.

Vermont Income Tax Forms. Ad Compare Your 2022 Tax Bracket vs. Below are forms for prior Tax Years starting with 2020.

W-4VT Employees Withholding Allowance Certificate. Filing Status is Married Filing Jointly. Are you eligible for Free File.

Then your VT Tax is. Subtract 75000 from 82000. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes.

Tax Rate Single Married. Base Tax is 2727. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

PA-1 Special Power of Attorney. 204001 - No limit248351 -. Discover Helpful Information and Resources on Taxes From AARP.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. The major types of local taxes collected in Vermont include income property and sales taxes. Vermont State Income Tax Forms for Tax Year 2021 Jan.

Vermont School District Codes. The 2022 tax rates range from 335 on. Check the 2021 Vermont state tax rate and the rules to calculate state income tax.

Tax Rates and Charts Mon 03012021 - 1200. 15 15 15 15. IN-111 Vermont Income Tax Return.

Vermont School District Codes. FY2022 Education Property Tax Rates as of August 18 2021. The percent change in personal income across all states ranged from 85 percent in South Dakota to 13 percent in Hawaii.

2021 VT Rate Schedules. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902. 0 0 0 0.

Free Tax Help for Vermonters. Enter 3189 on Form IN-111 Line 8. IN-111 Vermont Income Tax Return.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government. There are a total of eleven states with higher. Bureau of Economic Analysis BEA table 1.

Eligible actually used Free File to file their taxes. Ad The Leading Online Publisher of National and State-specific Family Law Legal Documents. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Only about 12000 or about 6 of those. 34 rows 2021 Vermont Income Tax Return Booklet. Your average tax rate is 1198 and your marginal tax rate is 22.

2021 Vermont Tax Tables. Multiply the result 7000 by 66. This booklet includes forms and.

TAX DAY NOW MAY 17th - There are -387 days left until taxes are due. Details on how to only prepare and print a Vermont 2021 Tax Return. Start filing your tax return now.

Multiply the result 7000 by 66. Vermont State Payroll Taxes. To find out visit taxvermontgovfree-file.

2021 VT Tax Tables. In 2021 about 200000 Vermont taxpayers. State personal income increased 48 percent at an annual rate in the first quarter of 2022 after increasing 36 percent in the fourth quarter of 2021 according to estimates released today by the US.

Find your income exemptions. Find your pretax deductions including 401K flexible account contributions. Obligations or 2 Tax Rate ScheduleTax.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. At Least But Less Single Married Married Head of. The Vermont tax rate is unchanged from last year however the income tax brackets increased due to the annual.

Tax Rate 0. 22 22 22 22. A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals.

VT Taxable Income is 82000 Form IN-111 Line 7. How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Here is a list of current state tax rates. 40351 - 9780067451 - 16300076. Ad Get Ready for Tax Season Deadlines.

Detailed Vermont state income tax rates and brackets are available on this page. 2020 VT Tax Tables. New York Income Tax Calculator 2021.

12 12 12 12. Before the official 2021 Vermont income tax rates are released provisional 2021 tax rates are based on Vermonts 2020 income tax brackets. 18 18 18 18.

Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. The effective FUTA rate paid by Vermont employers will be only 06. 97801 - 204000163001 - 248350875.

A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate. These back taxes forms can not longer be e-Filed. Vermont Income Tax Calculator 2021.

2021 Vermont Tax Rate Schedules. 8 8 8 8. Now that were done with federal payroll taxes lets look at Vermont state income taxes.

Meanwhile total state and local sales taxes range from 6 to 7. Find your gross income. Vermont charges a progressive income tax broken down into four tax brackets.

And your filing status is. ESTIMATED TAX PAYMENTS These due dates apply to a calendar-year taxpayer. The 2021 state personal income tax brackets are updated from the Vermont and Tax Foundation data.

5 5 5 5. 2022 Income Tax Withholding Instructions Tables and Charts. For Adjusted Gross Incomes IN-111 Line 1 exceeding 150000 Line 8 is the greater of 1 3 of Adjusted Gross Income less interest from US.

2020 VT Rate Schedules. Your 2021 Tax Bracket to See Whats Been Adjusted. PA-1 Special Power of Attorney.

0 - 403500 - 6745066. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large.

W-4VT Employees Withholding Allowance Certificate. West Virginia Income Tax. Were eligible to e-file their federal and state taxes through Free File for FREE.

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

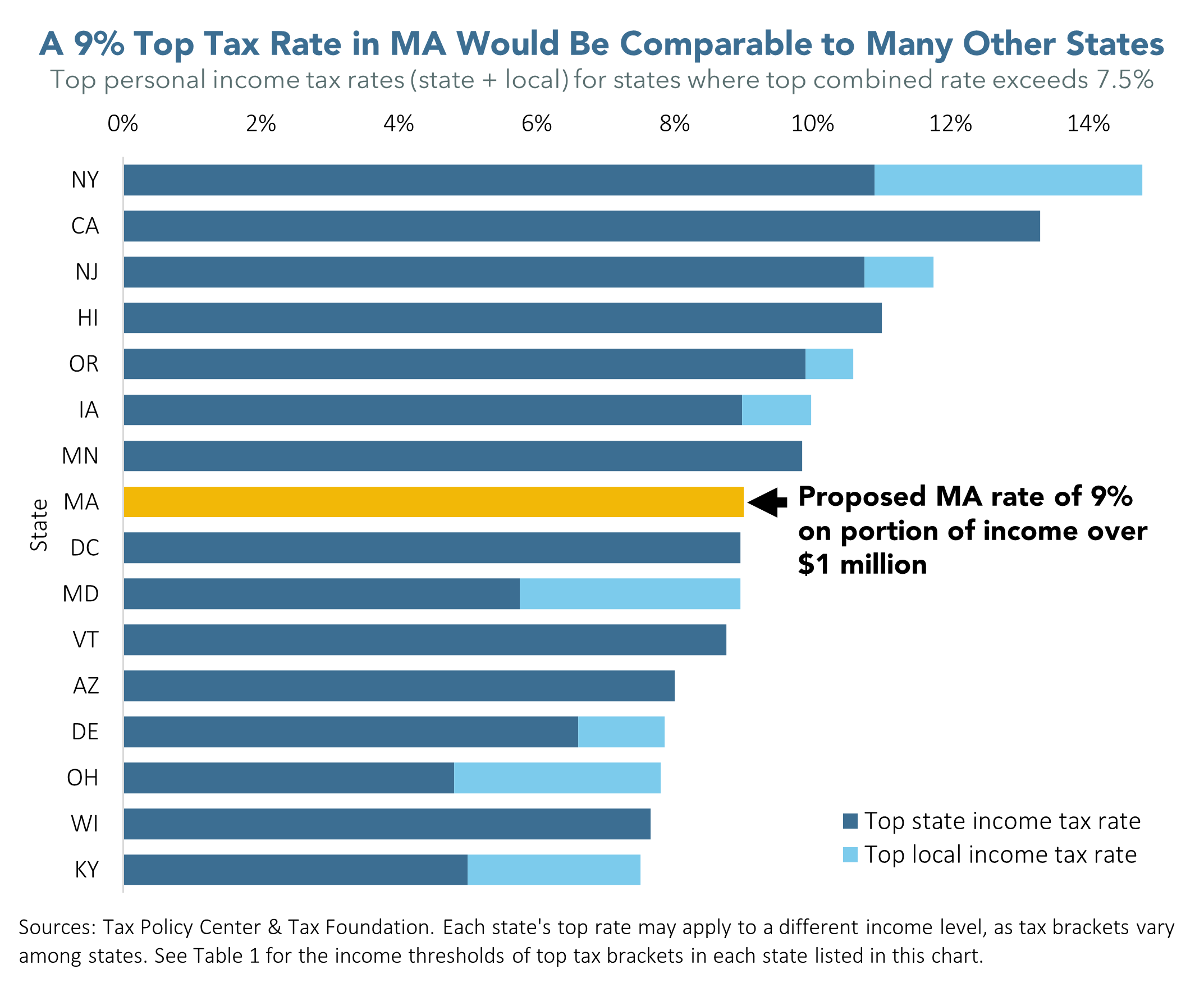

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With Highest And Lowest Sales Tax Rates

The Most And Least Tax Friendly Us States

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Estate Tax Everything You Need To Know Smartasset

Experts Weigh In On Inflation Interest Rates The Economy Vermont Business Magazine

State Income Tax Rates Highest Lowest 2021 Changes

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

2022 Eligibility Tables Vermont Health Connect

Publications Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Income Tax Calculator Smartasset