are my assisted living expenses tax deductible

Independent living expenses are not generally tax deductible unless you live in a Life Plan community sometimes referred to as a continuing care retirement community. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Free means free and IRS e-file is included.

. Is assisted living tax deductible in. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of the expenses or fees can potentially be deducted to make this a more affordable option. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction.

To be sure youd have to check with your specific assisted living community. Assisted living entrance fees may count as a medical expense for tax purposes and assisted living facilities must outline to you the portion of their fees that are medical-related. This deduction can be taken on your federal income taxes.

People often ask us is assisted living tax deductible. However some facilities might have a level of medical care covered in their room and board specifications and fees. Any of these medical expenses could be tax-deductible as long as.

Its important to note that each financial situation is unique and personal and that a tax advisor can help you sort through your own taxes to uncover deductions that may apply to you. Max refund is guaranteed and 100 accurate. For a more traditional independent living community monthly fees are not typically tax deductible.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. It is just that simple. Ad All Major Tax Situations Are Supported for Free.

YOU must do the math yourself. Easily Track Your Business Expenses - Get Started With QuickBooks Today. You can also subtract the medical expenses of qualifying relatives from the final amount of taxes you need to pay.

Yes assisted living expenses are tax-deductible. Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters. There is no IRS form or worksheet in the TT program.

In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

Ad Take Some of the Stress Out of Unplanned Expenses with AARP Money Map. Medical expenses and some long-term care expensesare deductible if the expenses are more. Medical expenses and including some long-term care expenses can be deductible if they are more than 75 of.

The deduction of 41850 486006750 should help out a great deal. Can I deduct these expenses on my tax return. Using this tax deduction can save you or your parent money on the cost of medical and care expenses that make up part of the cost of Assisted Living.

Find Fresh Content Updated Daily For Tax deductions for assisted living. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid during the 2020 tax year. Qualifying relatives include your siblings and their children.

TurboTax also notes that assisted living expenses can be tax deductible for individuals needing supervision because of cognitive impairment such as dementia or Alzheimers. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. To be able to itemize these deductions for the medical services you will.

If Dad figures adjusted gross income of say 90000 then he can deduct the expenses over 75 of 90000 6750. Any of these medical expenses could be tax-deductible as long as. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

As assisted living costs continue to rise each year it is good to know that you can get a break from the taxman. And the good news is that some of your assisted living costs are tax-deductible. Ad Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

Unexpected Expenses May Disrupt Your Life and Unsettle Your Financial Situation. Because only the medical component of assisted living costs is usually tax-deductible room and board doesnt often qualify as a tax-deductible expense. Start Your Tax Return Today.

Answer Yes in certain instances nursing home expenses are deductible medical expenses. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. Is Assisted Living Tax Deductible.

Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. For example if your AGI was 50000 last year then you can claim the deduction for the amount of medical expenses that exceed 3750. You can deduct assisted living expenses if you or your spouse is a qualified individual.

Assisted living entrance fees may count as a medical expense for tax purposes and assisted living facilities must outline to you the portion of their fees that are medical-related. So if it costs 60000 per year for the facility and the letter tells you 50 is for medical then you will enter 30K as medical expenses. However if you or your loved one receives medical services via a visiting.

Assisted Living for a Qualifying Relative. To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug expenses. 0 Reply Critter Level 15 March 27 2020 623 PM 0 Reply carolntim Level 2.

Obviously your own medical expenses are tax deductible and the same for your spouse and children. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

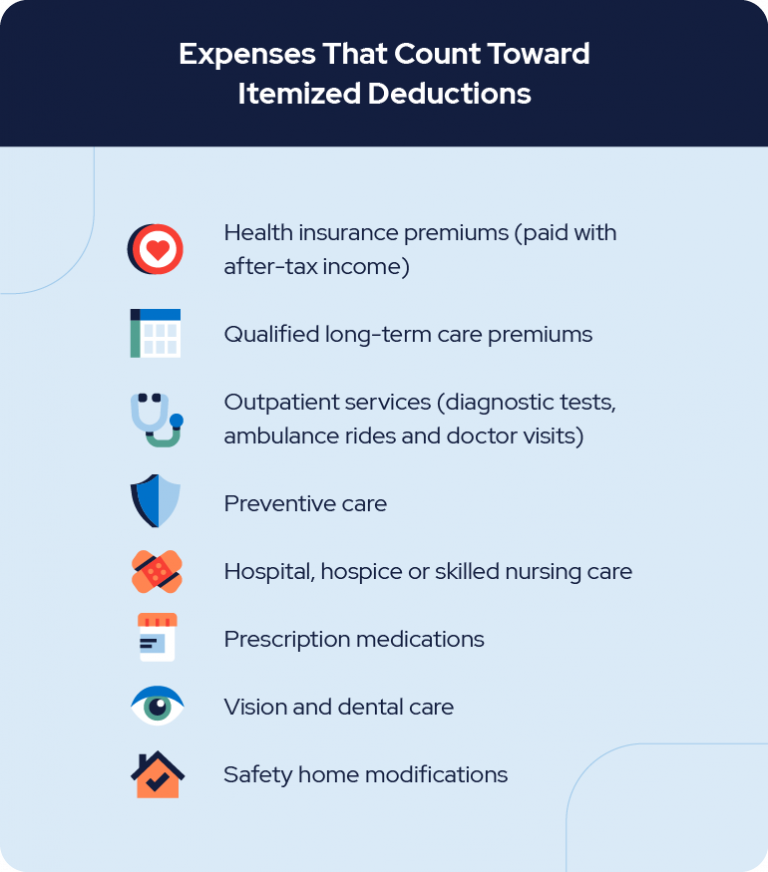

Common Health Medical Tax Deductions For Seniors In 2022

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

Tax Deductions For Assisted Living

Articles What Tax Deductions Are Available For Assisted Living Expenses Seniors Blue Book

Free Bookkeeping Forms And Accounting Templates Printable Pdf

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Common Health Medical Tax Deductions For Seniors In 2022

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran

Pin By Damon Mcguire On Budget Project Budgeting Job

91 Of Americans Don T Know Medicare Premiums Are Tax Deductible

Direct Payment Of Medical Expenses And Tuition As An Exception To The Gift Tax The American College Of Trust And Estate Counsel

Retirement Planning An Infographic Retirement Savvy

Itemized Deductions Medical Dental Expenses 550 Income Tax 2020 Youtube

6 Money Management Tips To Aid Your Startup Success Infographic